With the development of modern technologies, the financial industry is gradually moving into the digital plane. People are looking for safe and profitable ways to invest their money, so DeFi technologies are now one of the fastest growing sectors in the crypto market.

What will you learn from this article:

- What is DeFi? How DeFi works?

- What is a smart contract?

- Differences between DeFi and CeFi

- Advantages and disadvantages of DeFi

- DeFi use cases

What is DeFi?

DeFi (Decentralized Finance) is a system consisting of various financial instruments, services, applications based on blockchain and working without a single regulator. This technology is a full-fledged alternative to the traditional banking system that allows absolutely everyone to use the available financial platforms. People using private wallets or decentralized finance platforms can buy and sell cryptocurrencies, make deposits, take loans and so on.

How DeFi Works?

All financial transactions are carried out thanks to smart contracts that perform a given algorithm. Users connect in a peer-to-peer network, and they do not have to decide which of them should send the funds first, as smart contracts do everything for them. It is worth noting that the first smart contracts appeared on the Ethereum network, so most of the DeFi services work there today.

At first glance, it may seem that this is a completely closed and insecure system that can simply steal a person’s money. In fact, to understand the work of the blockchain, you do not need to have special knowledge in this area, since all operations are performed openly, and many platforms place the data of transactions in open access.

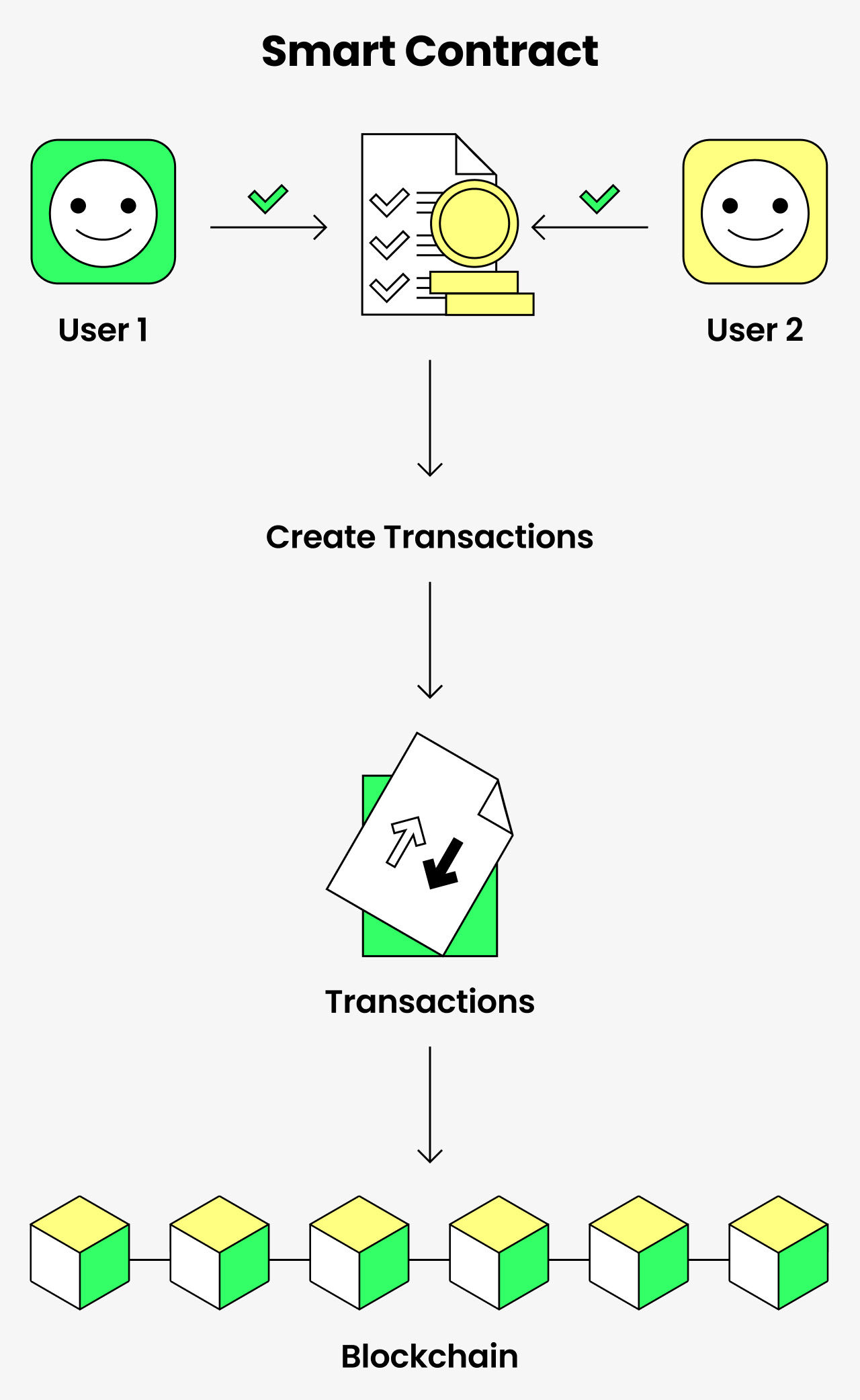

What is a Smart Contract?

As mentioned earlier, this is a kind of algorithm that monitors the fulfillment of all the terms of the contract. In the real world, to conduct a transaction, you need to contact a lawyer or notary, after which you will face bureaucratic difficulties. The process is quite complicated, time-consuming and financially costly.

Smart contracts enable users to make transactions quickly and, most importantly, safely, so this system is considered a worthy analogue of the traditional economy. In addition, one of the participants may even be fined by the system for dishonest attitude to the fulfillment of the terms of the contract, which makes it even more reliable.

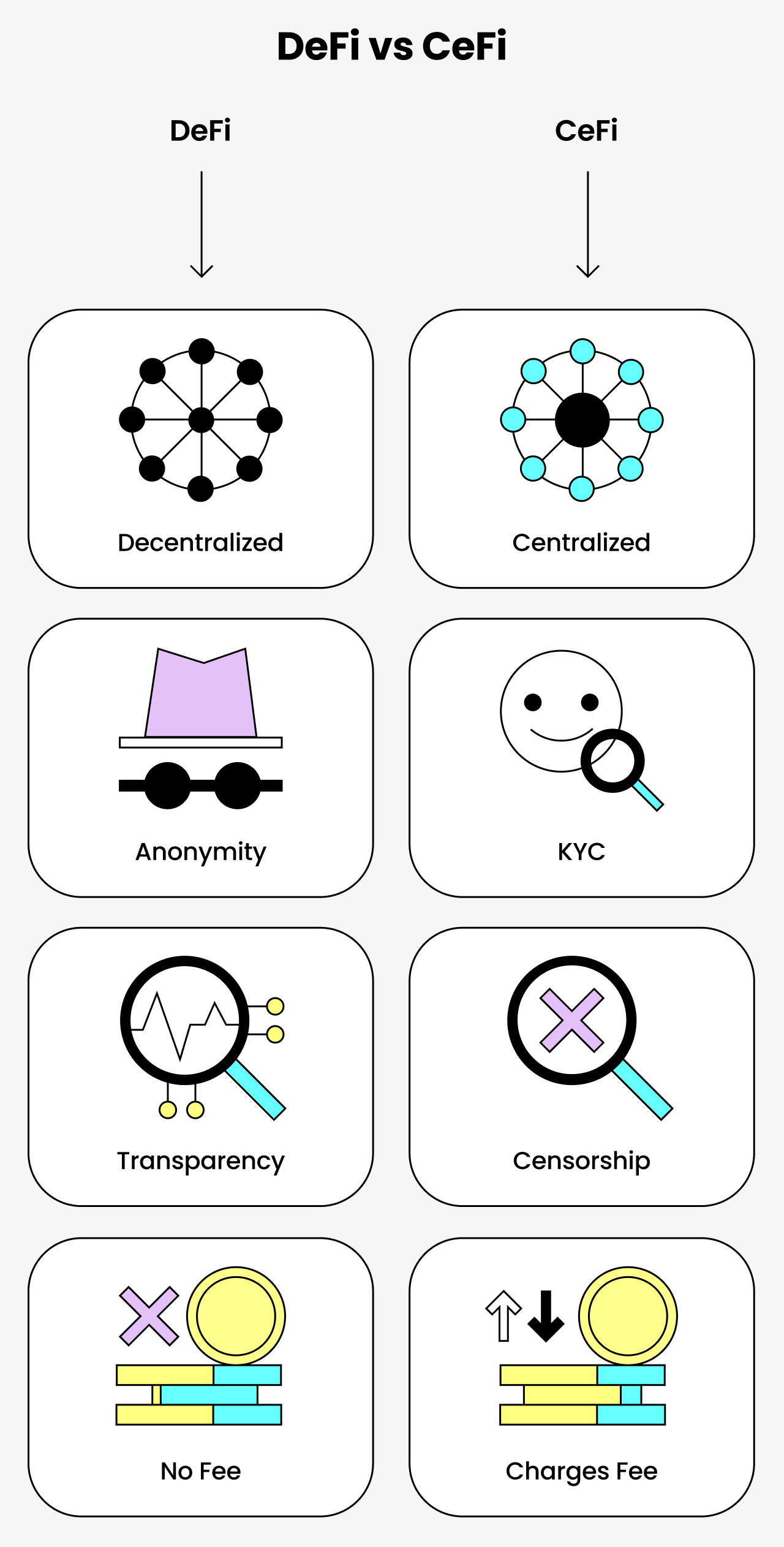

Differences between DeFi and CeFi

Centralized and decentralized financial platforms offer users similar opportunities on different terms. It is necessary to highlight the key distinctive features of each sector to understand the principle of their work.

What is CeFi?

CeFi (Centralized Finance) — financial activities that are controlled by a single management body (regulator). Most of the centralized finance services are exchanges and wallets that comply with the established rules of local authorities. For example, in order to make any transactions, the user will have to pass identity verification (KYC — Know Your Client system). Such institutions store the data of their users and have access to them, but guarantee their security from third parties.

Defi vs CeFi

Firstly, there is no regulator in DeFi — smart contracts take over all the work, while in CeFi all transactions are strictly regulated by the main institution.

Secondly, to perform financial transactions in centralized systems, the user must verify his identity. To use the decentralized finance services/tools, you only need a desire, because the services are available to absolutely everyone.

Thirdly, DeFi services do not hide the operations performed, but centralized financial institutions can censor transactions.

And last but not the least, centralized services charge a commission for the services provided by intermediaries, while decentralized ones do not charge any additional fee.

Thanks to its many advantages, decentralized finance has become one of the fastest growing sectors of the blockchain industry, with more than 2.7 million ETH blocked.

Advantages and Disadvantages of DeFi

DeFi technology provides users with a huge number of opportunities and this whole big system has both its pros and cons.

Benefits of DeFi

Decentralized financing offers the following convenience to users:

No regulator. Decentralized financing allows people to be responsible for their own assets. Due to the absence of a regulator, account data (private key) is stored in the form of ciphers and keys, which only one person has access to — the owner of a wallet or other tool. This significantly reduces all the risks of hacking, but at the same time forces a person to carefully monitor the safety of their data.

Availability. Access to DeFi tools is provided to absolutely everyone who has the Internet connection on their device. Participation in the market does not require verification or a positive credit history, which attracts a large number of people. This is a big advantage over a bank account and traditional finance.

Transparency. DeFi protocols are open source, so anyone can use them to view the history of transactions, audit and other purposes.

Anonymity. The use of financial services does not imply identity verification procedures.

No extra charges. Due to the fact that transactions are made without intermediaries such as a bank or broker, users do not have to pay an additional fees.

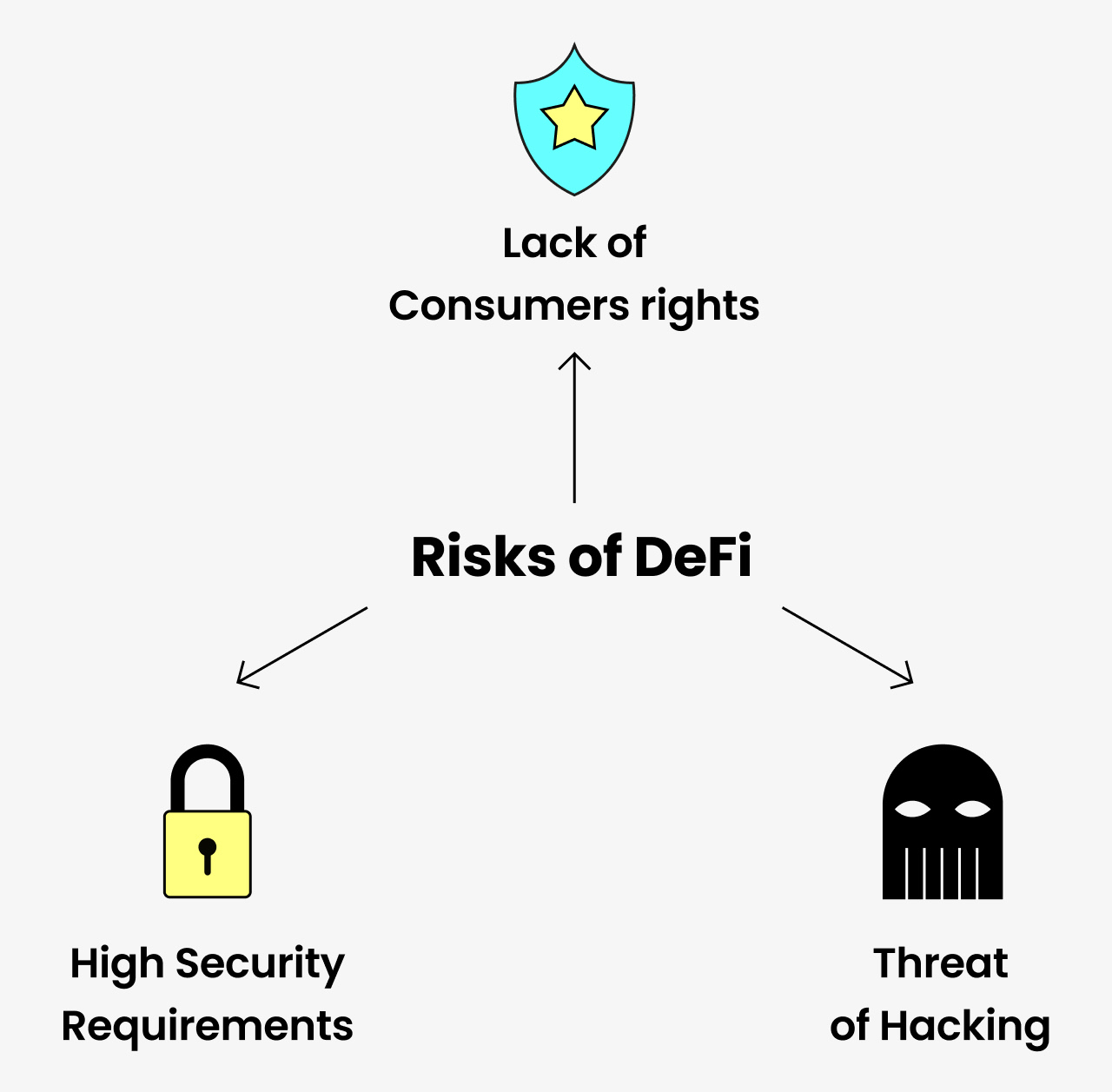

Risks of DeFi

Despite the fact that there are not so many disadvantages, you are definitely need to be warned about them before using decentralized platforms:

Lack of consumer rights. No government agency or central regulator will be able to help you if you are deceived or you accidentally transfer funds to the wrong address. Market participants are totally not protected, so they have to conduct transfers on their own responsibility.

High security requirements. No one except the owner of the DeFi wallet has access to his assets, so one need to take its security seriously. In case of loss of the secret key, the funds remaining on wallet will be impossible to return.

Threat of hacking. Centralized platforms are exposed to this risk to a greater extent, but this does not mean that it is completely absent in decentralized finance. Throughout the history of the industry, there have been many cases of theft and hacking of smart contracts, when hackers were able to find vulnerabilities in the system.

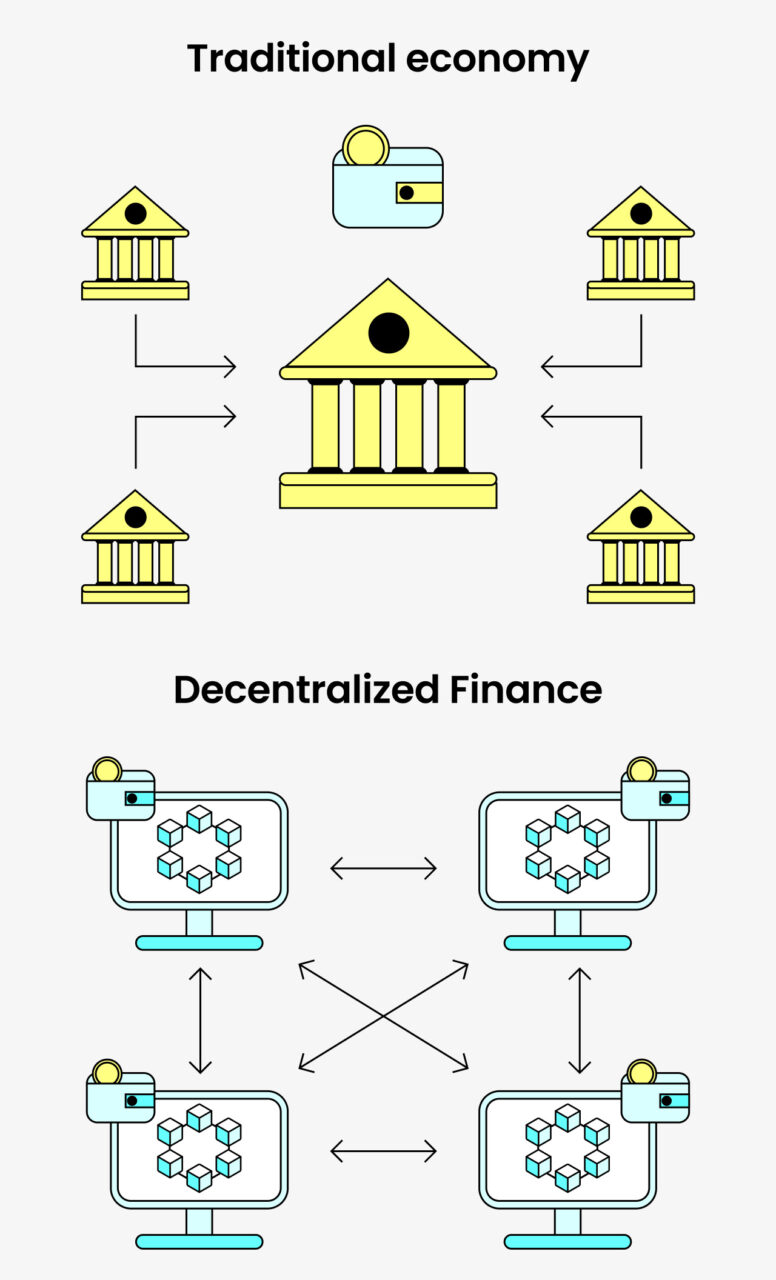

Nevertheless, people still prefer a system of decentralized finance rather than a traditional economy. This is what the work of the two structures looks like:

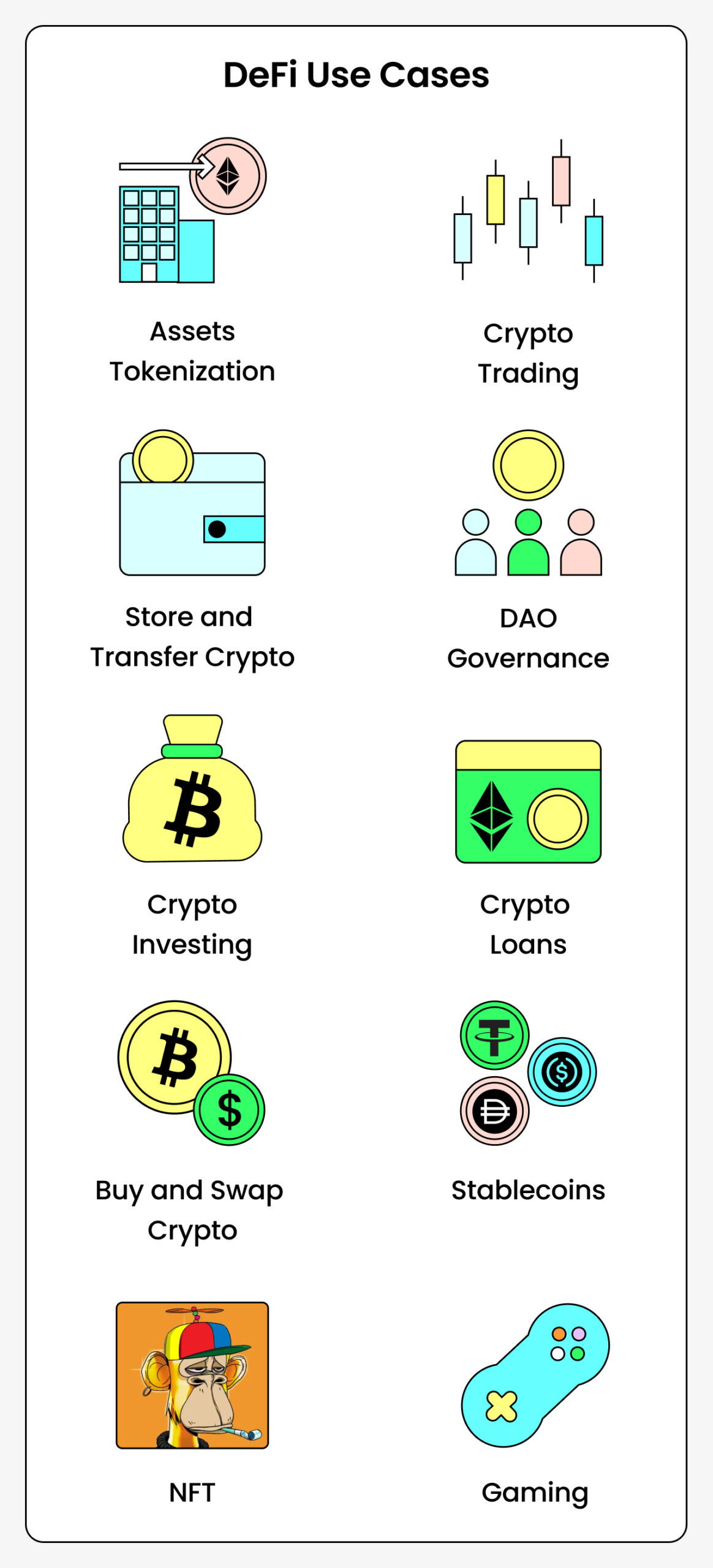

DeFi Use Cases

Today, the technology of decentralized financing provides a huge number of opportunities to all users. All financial instruments are analogs of the traditional financial system, but they have some distinctive features.

Buy, Sell and Swap Cryptocurrencies

Almost all decentralized platforms enable users to perform various operations with their assets, for instance, you can buy a cryptocurrency, sell it at the market price, or swap for another token at any time. To exchange one cryptocurrency for another, you need to enter the spot market and perform the necessary operation. The transaction takes place instantly, so this is one of the easiest ways to trade cryptocurrencies.

Crypto Trading

Crypto derivatives. A derivative is a financial instrument, which value depends on the underlying asset. In DeFi, this asset is crypto. In other words, by purchasing a crypto derivative, you enter into an agreement with another user to transfer tokens within a certain period and at a certain price. The most popular derivatives in DeFi are futures and options. Today, there are many protocols offering, for example, option contracts. Such products as Opyn and ACO allow users to sell and buy option contracts with 100% collateral. There is no hedging of the seller’s risks in this process, so the premiums for such contracts are very high.

Margin trading. In the field of DeFi, margin traders borrow cryptocurrencies from decentralized credit protocols based on smart contracts. An example of such a platform is dYdX. It is one of the largest margin trading platforms in DeFi; currently, over $1.2 billion is blocked in its smart contracts. DYdX is a decentralized application that requires a web3 wallet connection to work with. Registration or verification is not necessary, all operations are carried out by users anonymously.

Perpetual futures. This is a special type of futures trading, the distinctive feature of which is the absence of an expiration date. The investor can hold the position as long as he considers it necessary. Unlike conventional futures, perpetual contracts are often traded at a price that is equal to or very similar to the price on spot markets. There are many DeFi platforms with the ability to trade perpetual futures that do not require identity verification.

Scalp trading. A relatively popular trading strategy that involves buying and selling cryptocurrencies several times during the day with a small profit. Most often, traders close a position within 15 or 20 minutes from the moment of its opening, thereby earning a small difference in the token rate. This strategy is popular by users in the cryptocurrency market due to its high volatility. Users can engage in scalping on any decentralized platform that allows them to buy and sell cryptocurrencies.

Store and Transfer Crypto

DeFi wallets are applications and devices that allow you to store the private and public key of digital coins by yourself, without trusting it to third-party companies. The creation of such wallets takes no more than two minutes, and the usage does not require identity verification. All the owner needs is to keep a secret phrase that gives access to assets. Good examples of such wallets are Metamask, Trust Wallet, MyEtherWallet and so on.

In addition, you can easily send cryptocurrency to other accounts by simply copying the recipient’s address. Such an operation is performed in no more than 2 minutes and also does not require confirmation of additional registration.

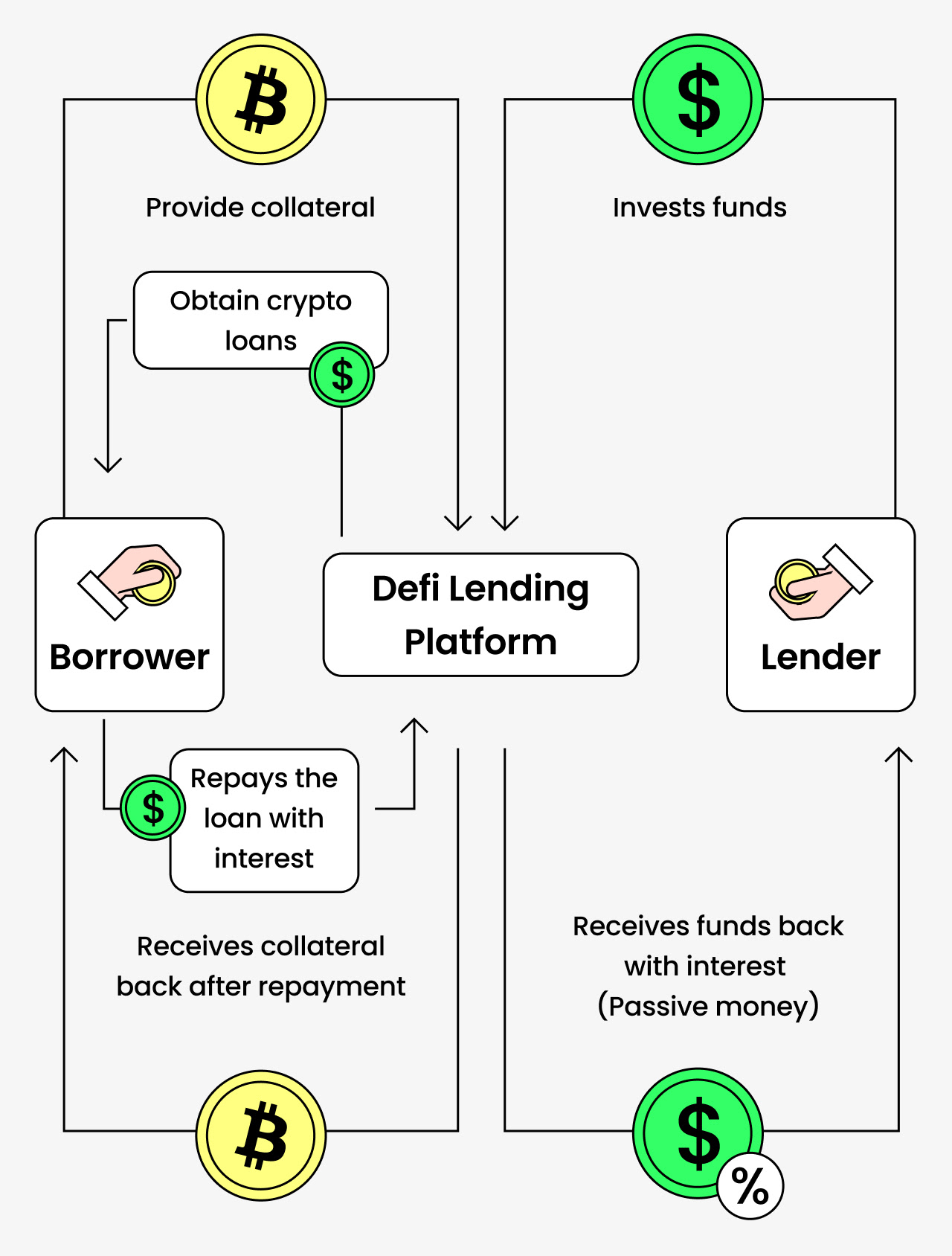

Crypto Loans

Traditional lending works according to the following principle: people and financial organizations provide money to other people or organizations for a certain period of time. The borrower pays for using funds to the lender, thus the lender receives passive income. Banks or brokers act as intermediaries in all of these operations and charge a certain fee for their services. They control the entire process and document the transaction.

Crypto loans enable borrowers to receive money on more favorable terms than in a bank, and the lender to receive a higher income for providing their assets. Moreover, DeFi lending does not require the participation of third parties. All the work is taken over by smart contracts that execute algorithms according to the established credit conditions. The absence of intermediaries makes loans more affordable and faster to process, but at the same time increases the risk of losing the lender’s funds. To ensure the safety of funds, the borrower provides excess collateral.

In this scheme, the borrower provides collateral, which is usually more than 100% of the required loan amount to ensure the security of the transaction. The lender sends his money through a smart contract and after a certain time receives the initial amount with an added interest.

People choose this type of lending because it is more profitable than a traditional bank loan. The borrower is not required to have a good credit history, and the lender receives a more favorable interest, and neither party provides its personal data to intermediaries.

Crypto Investing

There are two ways to invest in DeFi: direct investment in tokens or depositing crypto assets into liquidity pools (staking).

The first method involves the purchase of various DeFi tokens, for example, UNI and Aave. Buying UNI or AAVE tokens actually means betting on this technology and ecosystem. The owners of these tokens make a profit on the coins market price growth, which is similar to the purchase of ordinary shares of the company.

Investors can also make money on staking. They can invest their funds in a liquidity pool and receive a certain percentage for lending their assets or engage in crypto lending. The advantage of DeFi staking is that there are no third parties who control the turnover of funds, because smart contracts take over all the work. Moreover, the yield of DeFi is significantly higher and the entry threshold is lower.

NFT

In recent years, the amount of investments in NFT projects from the space of decentralized finance has significantly increased. Moreover, we can observe the successful development of some platforms whose activities consist in a combination of DeFi technologies and NFT. For example, NFTfi is a new DeFi marketplace for issuing loans secured by NFT. Users can lend NFT or borrow them. In case of default by the borrower, the ownership of the NFT passes to the creditors.

Assets Tokenization

Asset tokenization is the creation of digital tokens with embedded value. Any assets that have a certain value can be tokenized. For example, there are tokenized stocks, buildings, oil, and even whiskey bottles. With tokens people can invest in expensive assets, such as company shares or real estate. Moreover, government of Austria issued Ethereum tokenized bonds for $1 bln.

Gaming

Decentralized financial services have covered the sphere of blockchain games. Today, you can simultaneously enjoy the game process and earn game tokens or NFT, which cost real money. This integration of DeFi and gaming is called GameFi. There are many platforms that offer users to perform various tasks and complete quests in games for a special reward. For example, Pulsar Farm is a DeFi game based on Binance Smart Chain and Polygon. Players can purchase alien pets as NFTs and use them in PvP games. Winning increases the pet’s level and the reward depends on how many times the opponent has been beaten in a row. The game uses a special BNT token, which can also be exchanged for another cryptocurrency in any convenient way.

DAO Governance

DAO (Decentralized autonomous organization) is such a decentralized platform that does not require a management company or a single regulator. Such projects are managed in accordance with the needs of society, so everyone can contribute to further development. There are several examples of using DAO in the modern world: protocol, philanthropy, investment, collector and grand DAO. Despite the fact that each of them has different functions, they are united by the absence of a governing body. All decisions are made collectively, and holders of project tokens can become participants of such associations.

Stablecoins

This is a crypto token which is tied to the price of the underlying financial instrument, for example, a currency. Decentralized stable coins are completely transparent and are not associated with storage. The token is secured in a smart contract and is not regulated by third parties in any way. Examples of such coins are DAI, USDT, BUSD and so on.

Summary

Despite experts’ fears that this financial structure is at risk of hacking or restrictions from the governments, the development of DeFi technologies continues and is gaining momentum every year. All disadvantages are easily compensated by the capabilities of this system, which allows absolutely everyone to use various financial instruments. The work of smart contracts is already being implemented in the institutions of the traditional economic system, so in the near future the scope of application of these technologies will expand significantly.

FAQ

Is Bitcoin a DeFi?

Of course, bitcoin is a great example of a decentralized financial project, because it is not controlled by the regulator.

Can you lose money in DeFi?

This is possible if an unexpected failure occurs in the smart contract or you lose access to your wallet or exchange.

What is an example of DeFi?

Good examples are Metamask and Trust Wallet and the Aave platform, which offers crypto loans services to users.

How can you make money with DeFi?

The easiest way to earn money on DeFi is to deposit your assets on a platform that will regularly pay you APY (annual percentage yield).

Is DeFi the future?

This financial sector continues its active development and every year the amount of blocked funds is growing. DeFi technology gives huge opportunities to users in terms of managing their capital, so experts predict a large-scale spread of decentralized finance in the economic system.