Famous crypto exchange platform and one of the top dogs in the DeFi sector Uniswap unveiled its third and most recent iteration Uniswap V3 on May 5, 2021.

Since the company’s inception in November 2018, Uniswap has ensured that the community can trade tokens without the need for middlemen or platform fees.

The recent iteration, Uniswap V3 is an example of how Uniswap has positioned itself as a world-leading DEX on multiple chains with the most recent being the imminent deployment on Zksync all in a bid to accelerate the mass adoption of cryptocurrency.

To achieve the dream of mass adoption, Uniswap posted on their social media platform that they have raised $165 million in Series B to bring the simplicity of Uniswap to more people worldwide. This is evident in the use of Uniswap protocols to build DeFi apps, Integrations, and tools like Mask, Opensea, and InstaDapp all forming part of the Uniswap Ecosystem.

All these worlds of accomplishment were possible by the innovative team at Uniswap and with the Unveiling of V3, Uniswap ensured that they remain a DeFi Top dog.

Before delving into the promising features and offerings of Uniswap V3. It will be imperative to talk about the previous generations created by Uniswap.

Understanding Uniswap V1 and V2

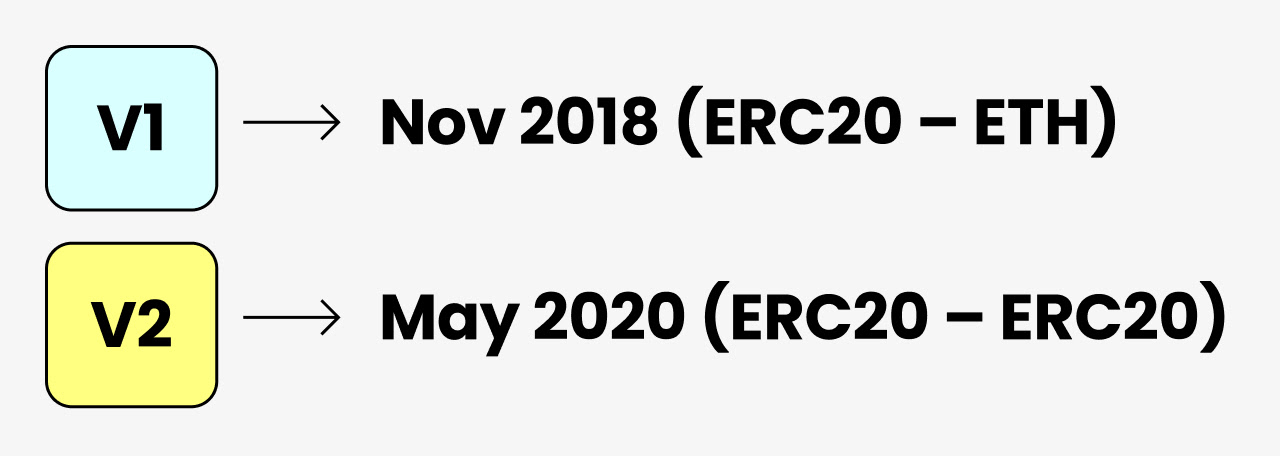

The launch of the first version of its protocol Uniswap V1 on November 2, 2018, introduced a seamless exchange of ERC20 tokens on Ethereum, and this caught the attention of everyone in the crypto space.

Uniswap V1 came with lots of top-notch features, including the ability to add support for any ERC20 token using Uniswap factory, and the cheapest gas cost of any decentralized exchange platform.

The ability to join liquidity pools with the introduction of LP Tokens was another feature of Uniswap. It ensured that every liquidity provider gets the amount of LP tokens relative to the percentage of total liquidity they added.

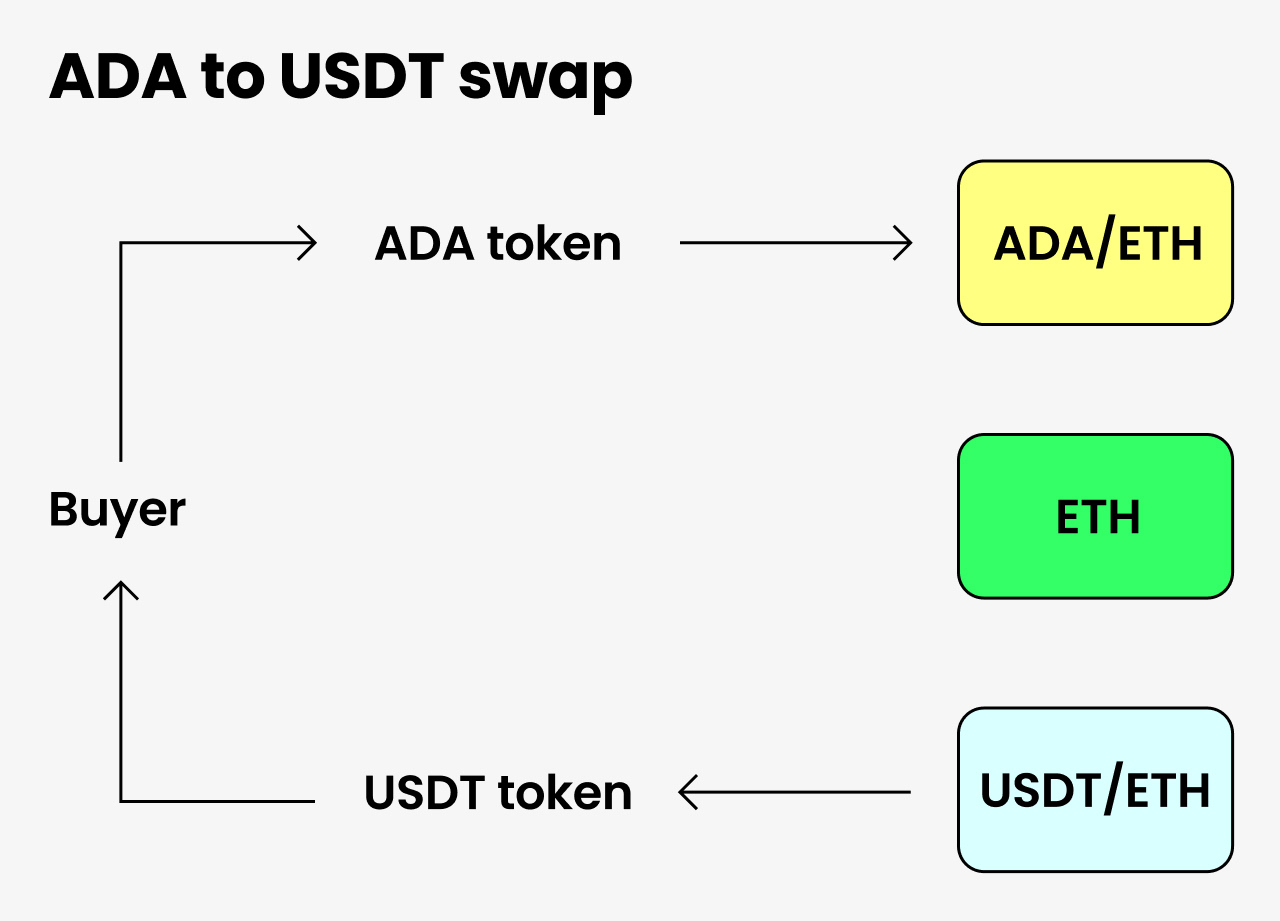

Uniswap V1 only supported trading from ETH – ERC20 meaning traders could only swap ETH for ERC20 tokens. For instance, traders who want to swap USDT for ADA will have to swap USDT for ETH. And then go to the ETH-ADA pool to get ADA.

Every trade carried out on Uniswap attracted a trading fee of 0.30%. Such fees returned to the liquidity reserve as a form of reward for Liquidity providers supplying liquidity.

Uniswap created an improvement on the promising Uniswap V1. This brought about the second version of the protocol Uniswap V2.

Uniswap V2

The second iteration of Uniswap V2 was a friendlier version of Uniswap V1. This brought about several new features which set the stage for monumental growth in the adoption of AMM (Automated Market Maker).

The protocol allows traders to swap from one ERC-20 token to another ERC-20 token without exposure to Ethereum. Unlike the Uniswap V1 where all liquidity pools are between ETH and ERC20 token.

Users who intend to swap their ERC20 token for another will incur higher prices and slippage. Likewise, the ability to directly swap from one ERC-20 token to another makes for an improved price since there is no exposure to Ethereum price fluctuation and traders will not suffer from any impairment loss.

Another feature that took the crypto world by storm was the introduction of Flash Swaps. This ensured that anyone can withdraw as many ERC20 tokens as they want without any upfront cost. They can either pay for all ERC20 tokens withdrawn, or return all ERC20 tokens withdrawn. Flash Swaps help to eradicate upfront capital demands and remove any restrictions on multi-step deals that use Uniswap.

Several reports have stated that since the launch of Uniswap V2, the company has amassed over $135bn in trading volume and ranked as one of the largest cryptocurrency spot exchanges in the world.

The Launch of Uniswap V3

The new iteration by Uniswap, V3 was launched on May 5, 2021, on “Mainnet” coming with it a bucket-load of new features all of which contributed to the increase in efficiency of the AMM (Automated Market Maker) model. This will benefit traders as a result of minimal price slippage, and minimal risk while maximizing returns for traders and Liquidity providers.

Top of the list of features brought about by Uniswap V3 is the introduction of the Concentrated Liquidity Concept. This concept allows Liquidity providers have the necessary control over the price range of their capital allocation while being able to set a higher or lower price on their pool portion.

Uniswap V3 promises up to 4000x capital efficiency compared to Uniswap V2. This ensures that Liquidity providers get a higher profit on their capital than they would on Uniswap V2.

Features of Uniswap V3

Explaining some of the features that came with the Uniswap V3:

Concentrated Liquidity

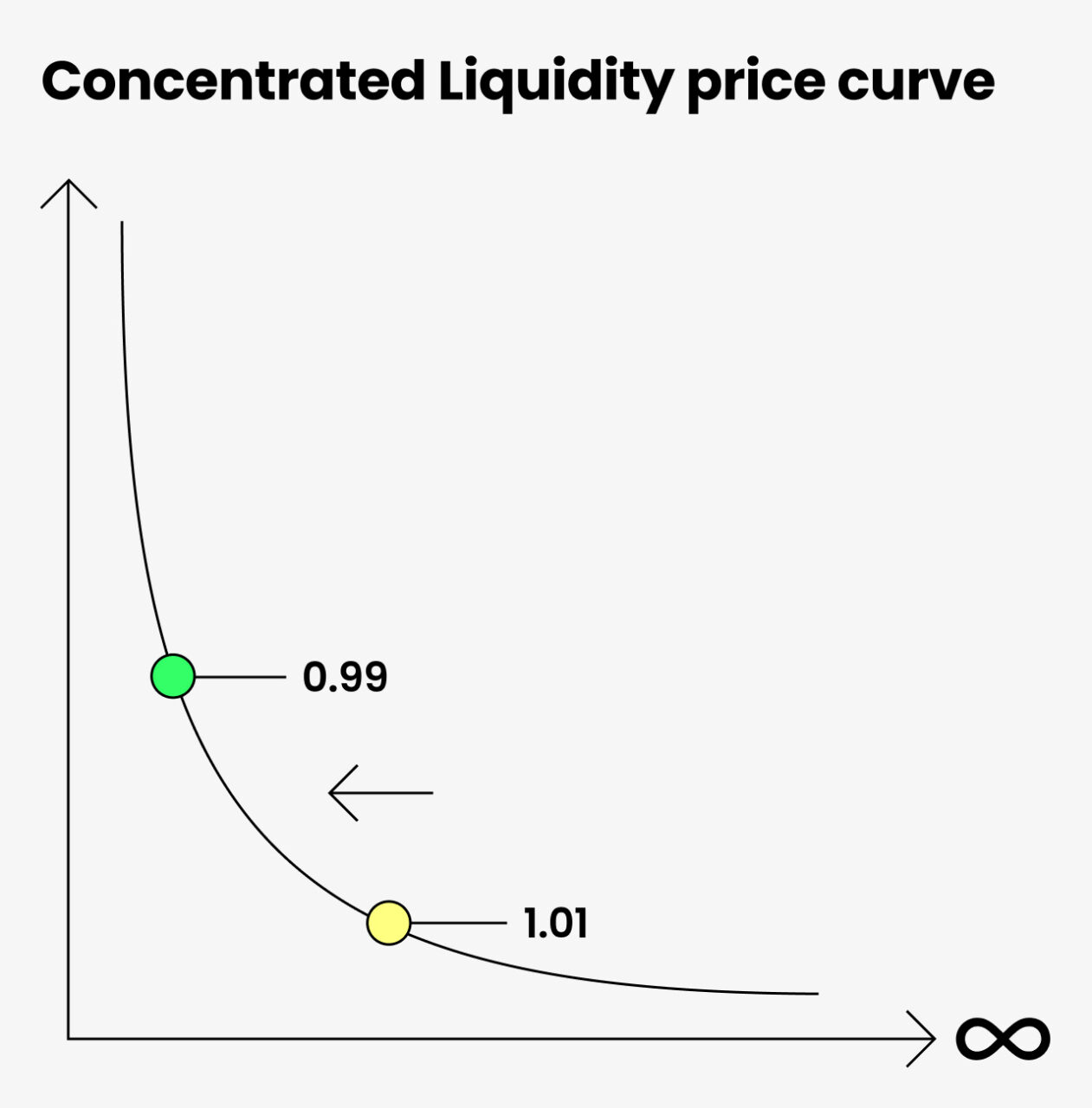

The most talked about and major offering of V3 was the Concentrated Liquidity. In the previous Protocol Uniswap V2 the trading price ranged between 0 and infinity, and this brought about an equal share in liquidity.

On V2, Liquidity providers only earn a small amount on their capital which is not enough to offset the risk that LPs take for holding large amounts of tokens.

An example of this is the V2 ADA/USDT pair reserves just ~0.5% of capital for trading between $0.99 and $1.01, which is the price range in which LPs would expect to incur the most volume and make the most trading fee. 99.5% of the capital was unused which can result in LPs earning fees on a smaller part of their capital.

In the new iteration of Uniswap V3, Liquidity can decide to set a custom price range when giving liquidity. This ensures they earn a greater amount of liquidity at a favorable price by focusing their capital in the range where the majority of trading occurs.

To accomplish this goal, V3 ensures that liquidity providers all get their price curves unlike before when they had to create a separate pool per a single curve which can lead to high gas costs.

With the adoption of Uniswap V3, users can trade against combined liquidity that is available at a given price range with no gas fee incurred.

Capital Efficiency

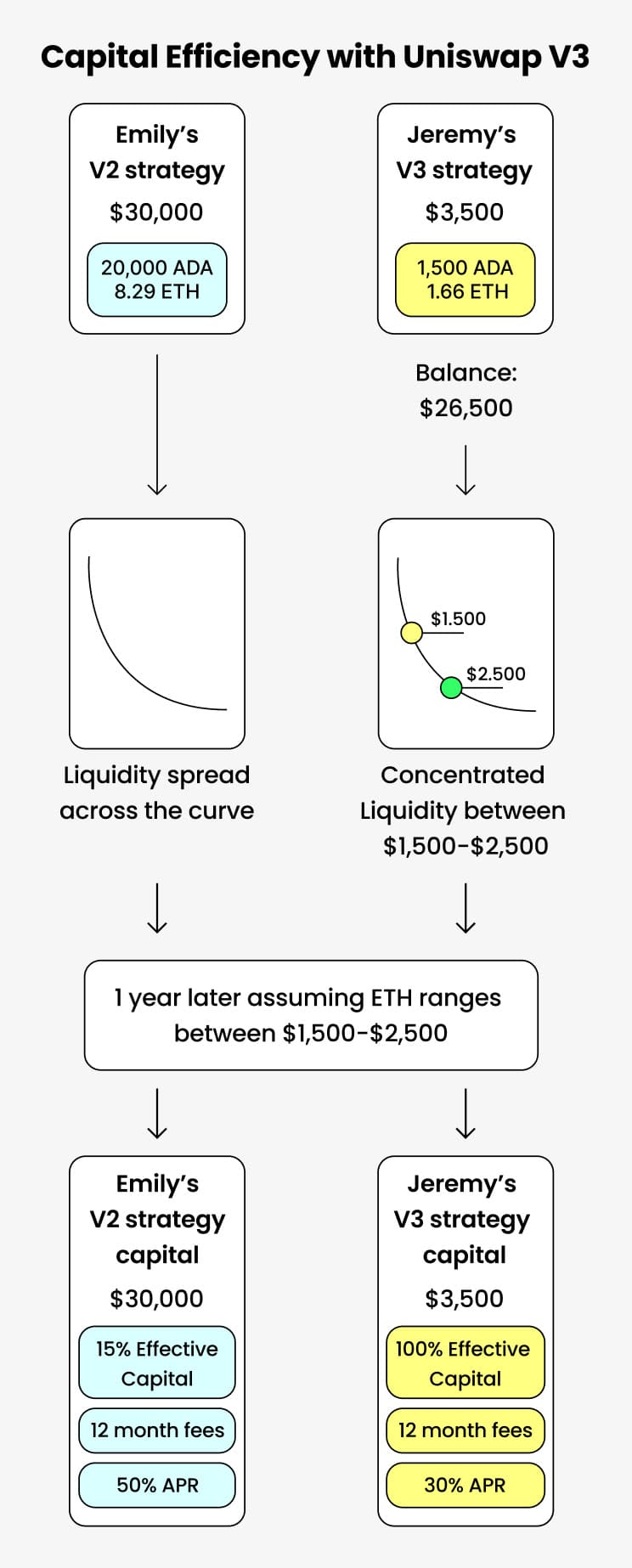

Through the concentration of their liquidity, Liquidity providers can provide the same liquidity depth as V2 with the given price range without incurring much risk on their capital. A perfect illustration of this was posted on the Uniswap blog post which is stated below:

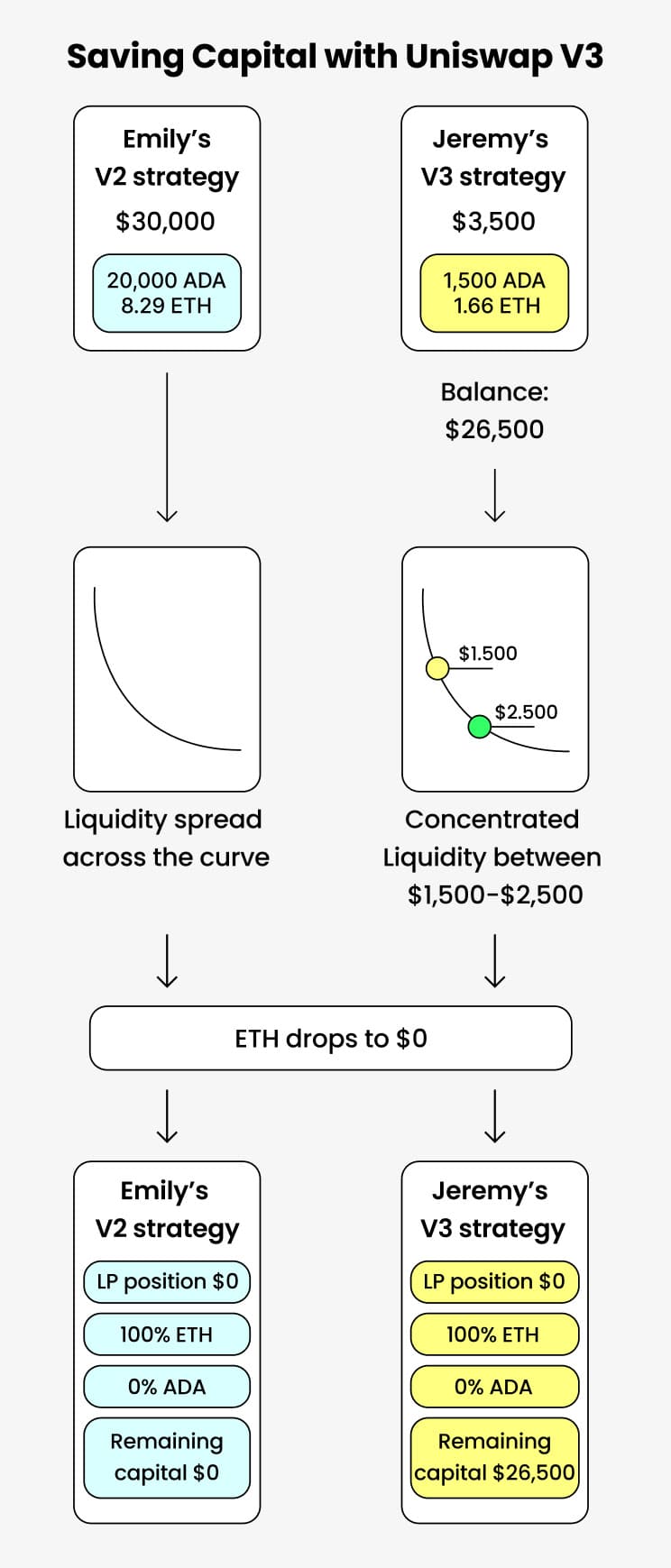

Emily and Jeremy both want to provide liquidity in the ETH/ADA pool on Uniswap V3. Each party has $30,000 and the trading price of 1 ETH is $1,206. Emily decides to place her capital across the entire price range (as done in Uniswap v2). She deposits 20,000 ADA and 8.29 ETH both amounting to $30,000.

Jeremy, on the other hand, decides to concentrate his liquidity and only deposit capital within the price range of 1,500 to 2500. He then deposits 1500 ADA and 1.66 ETH worth a total of about $3,500. The other $26,500 he keeps for himself, investing it in other ventures as he wishes.

While Emily has put down all her capital and Jeremy has put down a portion of his capital, they both will be earning the same amount of fees. As long as the ETH/ADA price stays within the 1,500 to 2,500 range. This means that Jeremy is incurring less risk on his capital compared to Emily.

In a situation where the price of ETH falls to $0, the loss for Emily will be brutal. While Jeremy will only lose $3,500 of his capital and he can use the remaining $26,500 as he wishes.

Finally, the maximum capital efficiency on the V3 is 4000x higher than that on the V2. And to add to that, the V3 pool factory will be able to support ranges up to 0.02% which equates to a maximum of 20,000x capital efficiency compared to that on the V2.

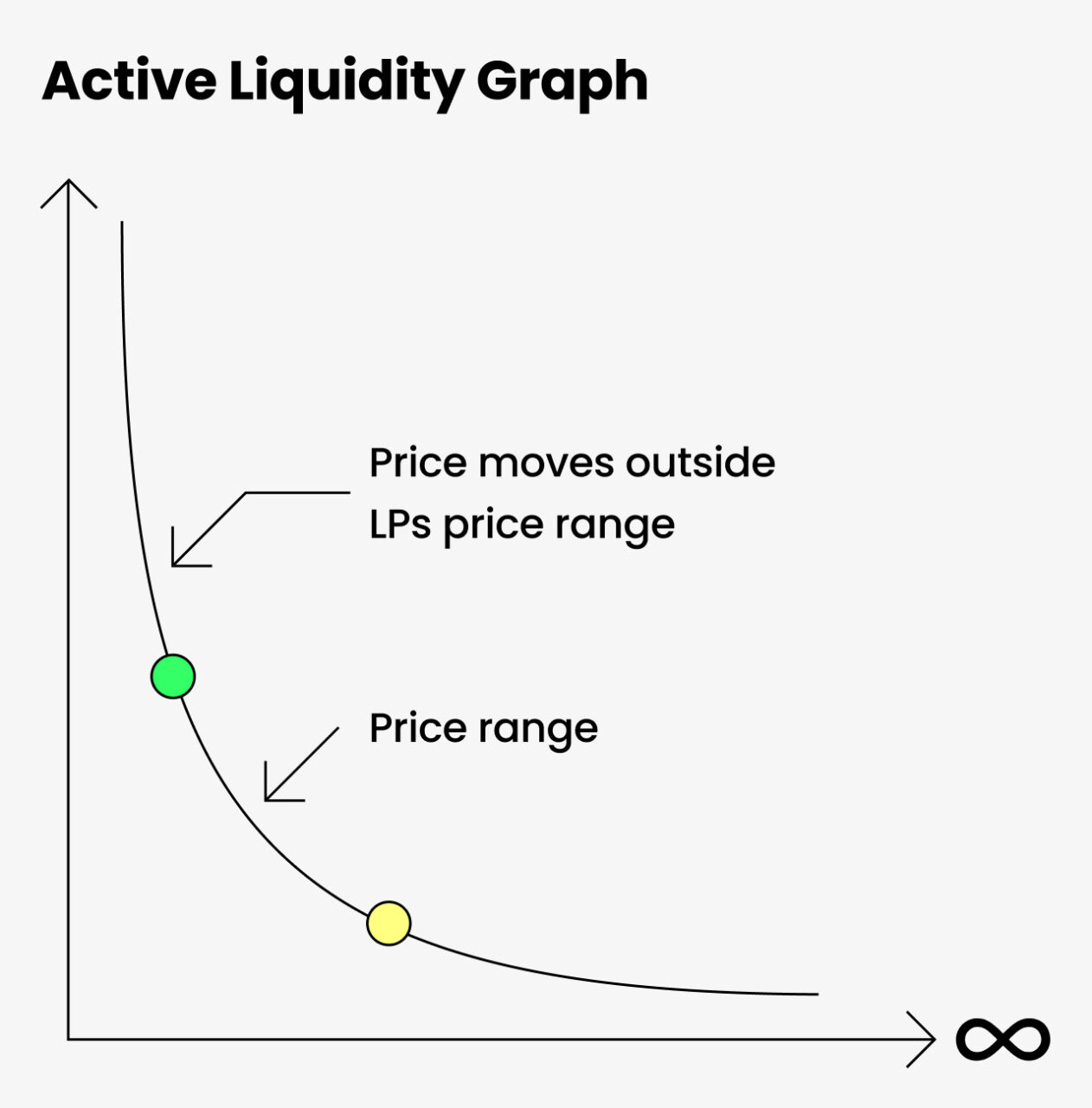

Active Liquidity

Another concept introduced on Uniswap V3 is Active Liquidity. In this concept, if the price of an asset trading in a liquidity pool moves outside of the liquidity providers price range, their liquidity is removed from the pool and will no longer earn fees. When such happens, Liquidity providers can either update their range to show current prices or wait for the market prices to move back to the desired range.

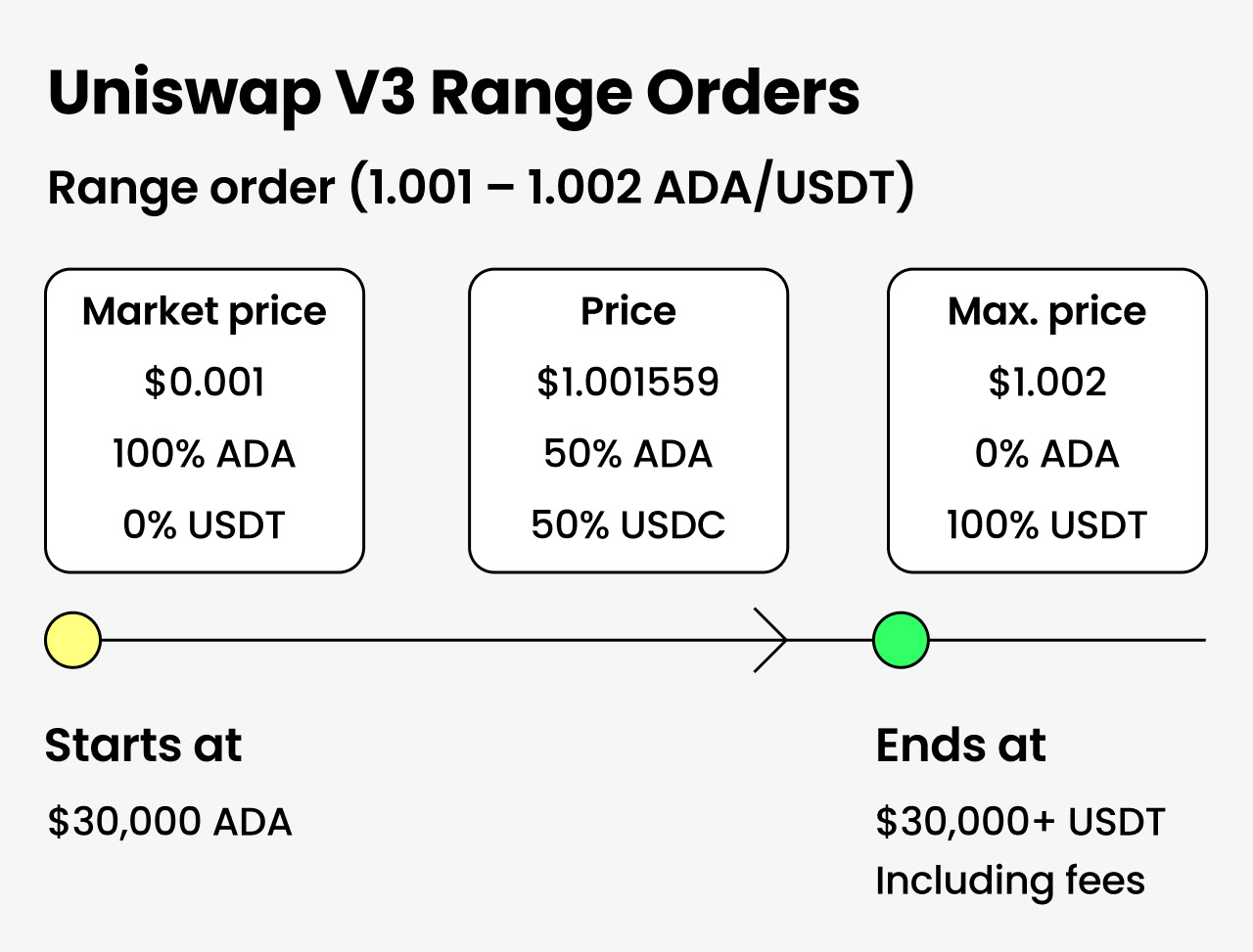

Range Orders

Another feature on the V3 is Range Order which is created to complement market orders. Liquidity providers provide a single token as liquidity in a custom price range above or below the current market price. When the market price enters a given range, one asset is sold for another asset along a smooth curve.

To further illustrate, when ADA/USDT trades below 1.001, a Liquidity Provider can choose to stake their ADA to a range between 1.001 and 1.002. Once ADA starts trading above 1.002 ADA/USDT, the Liquidity provider’s liquidity is converted into USDT. LPs must ensure the withdrawal of their liquidity to avoid automatic conversion back to ADA/USDT if it starts trading below 1.002.

Non-Fungible Liquidity

In Uniswap V3, each LP can create its price curveas earlietr stated in the Concentrated Liquidity Concept. As a result the liquidity positions are no longer regarded as ERC20 tokens as they are no longer fungible. But instead LP positions will be represented by non-fungible tokens through other partner channels.

Trading fees are also no longer automatically diverted back into the pool on the behalf of the LPs.

Flexible Fees

Uniswap V3 offers Liquidity providers three separate fees per pair – 0.05%, 0.30%, and 1.00%. This option ensures that Liquidity providers can streamline their margin based on any volatility experienced on any of the pair of fees. More risks can now be taken by LPs in non-correlated pairs (ETH/ADA). They also take minimal risks in correlated pairs (USDC/ADA).

Identical asset pairs are expected to come under the 0.05% and pairs like ETH/ADA will use 0.30%. Other assets might use of 1.00% swap fee which is more suitable. It is expected for identical asset pairs to congregate under the 0.05% fee. Pairs like ETH/DAI will use 0.30% while exotic assets might make use of 1.00% swap fees which is more suitable.

Advanced Oracles

When Uniswap V2 was launched, it introduced Time Weighted Average Price (TWAP) oracles and this was created to bring about stability in Uniswap protocols. These served as a critical piece of DeFi infrastructure and have been entrenched into a series of projects like compound which forms part of Uniswap ecosystem.

The introduction of Uniswap V3 came with it outstanding improvements to the TWAP oracle, some of which ensured that the cost of keeping oracles updated reduced by around 50% compared to Uniswap V2.

License

Due to the increasing number of copycats over the years like Sushiswap on previous Uniswap projects, the team at Uniswap has announced a time-delayed license for Uniswap V3.

As a result, Uniswap V3 core will launch under the Business Source License 1.1. This license limits the use of the V3 source code in any commercial or production setting for up to two years, which will later then convert to a GPL license in perpetuity.

Chain Agnostic

On January 17th, 2023, Ilia Maksimenka, CEO of the decentralized finance protocol Plasma Finance, argued in a proposal why Uniswap v3 should be deployed to BNB Chain. In his post, Maksimenka argued that the timing was ideal, citing the expiration of the license as one of the reasons. This proposal was supported by 80% of UNI holders, who voted in favor of the deployment.

Bottom-Line

With the launch of Uniswap V3, Uniswap ensures that they continue to stay on top in the DeFi space and remain one of the leaders DEX on multiple chains. So many other fascinating works have been done by the company some of which allows LPs to withdraw funds as easily as they deposited, also ensuring deeper liquidity than Binance and Coinbase, while supporting overt $1.2 trillions in trading volumes and facilitating over 100 million trades.

This is not the limit for Uniswap, as they promise to keep on setting the benchmark and continue to create a free and open internet for all and sundry.

Updated on 01/25/2023: added news about launch on BNB Chain.